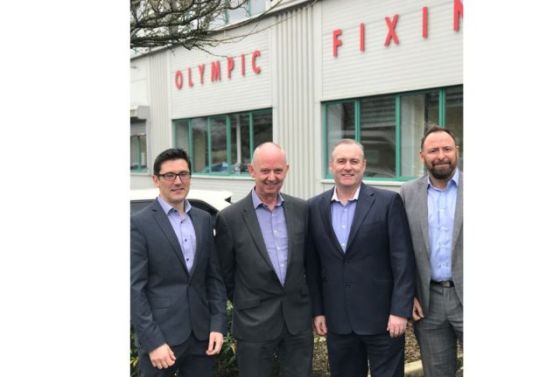

Olympic Fixings Group, which supplies hardware products to the merchant trade throughout the UK and Ireland, has made two senior appointments as it continues to strengthen its management team.

Paul Gordon has been appointed as Managing Director of the company, which employs over 60 staff in Altham, Lancashire and Bangor, Northern Ireland. Paul has over 25 years’ experience in senior management roles in the industry including as Managing Director of building products supplier SIG Distribution and of Wolseley UK’s Drain and Build Centre.

Meanwhile Gareth Wiliams has joined as Finance Director. He has over 15 years’ experience in finance, having trained as an accountant at KPMG and most recently was Finance Director of the Fast & Fresh group, which operates over 200 Subway stores in the North West.

The £10m turnover company has also recently welcomed Ade Solomon as UK Sales Director and Noel Hynes as Sales Director for Ireland. Ade previously worked for publishing and exhibition company Torque while Noel was a director for HSS Hire PLC and Speedy Hire PLC spanning 19 years.

Their appointments are part Olympic Fixings’ growth strategy following the £6m investment in the business by PHD Equity Partners and Secure Trust Bank last year.

Andy Dodd, who leads PHD Equity Partners, said the appointments were in line with PHD’s policy of investing in high-calibre management, and would also allow for the partial retirement of former director Cliff Yates.

“We are delighted to welcome the new management team on board,” he said. “All of them are highly experienced professionals with an impressive track record in the industry. Olympic Fixings is a sound business with potential to expand in the UK and Europe and these new appointments mean it is now ideally placed to pursue the growth opportunities.”

About PHD Equity Partners

PHD Equity Partners LLP was established in 2008 as the fund management arm of the DSW Group. PHD Equity Partners LLP raised its maiden £5 million private equity fund (“Fund 1”) in December 2008, followed by its first high yield debt fund in 2011. In December 2015 its second private equity fund, PHD Equity Partners Fund No. 2 LP (“Fund 2”), reached a final close of £20 million. The investment in Hylomar is the fourth investment from Fund 2.