Stanley Black & Decker has this week agreed to sell the majority of its Mechanical Security businesses to dormakaba for $725 million in cash.

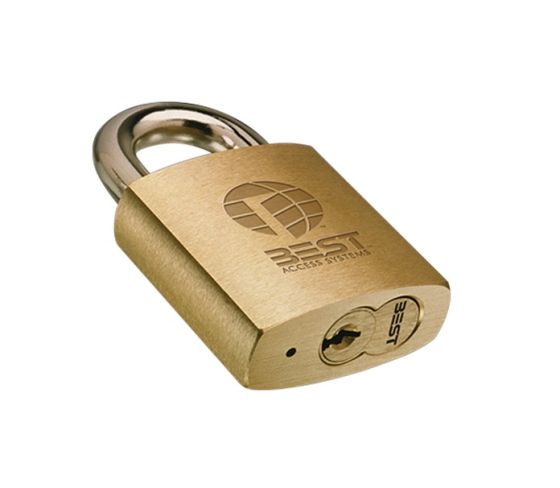

The sale includes the commercial hardware brands of BEST Access, phi Precision and GMT, which together represented 12 month revenues and EBITDA of approximately $270 million and $52 million, respectively.

The business said it was a strategic move, paving the way for Stanley Black & Decker to focus on the commercial electronic security business.

The transaction is expected to complete in Q1 2017 and the remaining part of the Mechanical Security businesses, Sargent and Greenleaf (LTM revenues of approximately $50 million), was not included in the sale. Stanley Black & Decker also announced that it intends to retain for the long-term its commercial electronic security (LTM revenues of approximately $1.5 billion) and automatic doors (LTM revenues of approximately $0.3 billion) businesses.

"After an extensive evaluation of our Security business, we are sharpening our focus on areas within our portfolio which are strategically attractive," explained President and CEO James M. Loree. "While BEST Access, phi Precision and GMT are healthy and profitable businesses, they are a better fit in dormakaba's portfolio and their divestiture will allow us to deploy capital in a more accretive and growth oriented manner. With this transaction and our decision to retain the electronic security and automatic doors businesses, we have concluded our previously announced Security portfolio assessment.

"The commercial electronic security business, with its inherent linkage to the digital world provides both a stable recurring revenue stream and an opportunity to develop and market high value, high growth customer solutions incorporating IOT, cloud, advanced analytics and other emerging technologies. Our scale and global footprint in this business is an excellent platform to build upon, both organically and inorganically. Our automatic doors business also represents an attractive growth opportunity for market expansion through both core and breakthrough innovation. We remain focused on applying the principles of our proven operating system, SFS 2.0, to enhance the growth, profitability and asset efficiency of these businesses."

This tax–efficient sale transaction is expected to generate net after-tax cash proceeds of $700 million, with capital loss carryforwards offsetting the majority of taxes otherwise due. The company expects the 2017 earnings per share impact of this transaction to be more than offset by accretion from the recently announced Newell Tools acquisition, newly identified low-interest financing strategies related to such acquisition, and the potential redeployment of excess cash proceeds for opportunistic share repurchases.

The Newell Tools acquisition is now expected to complete in Q1 2017.